In business, it's not enough to just rely on intuition or a good feeling that the company is doing well. Real insight only comes when you have specific numbersCRM Mango brings a set of reportswhich show reality - from economic results, through cash flow to vehicle utilization.

Sales report - a quick look at the results achieved

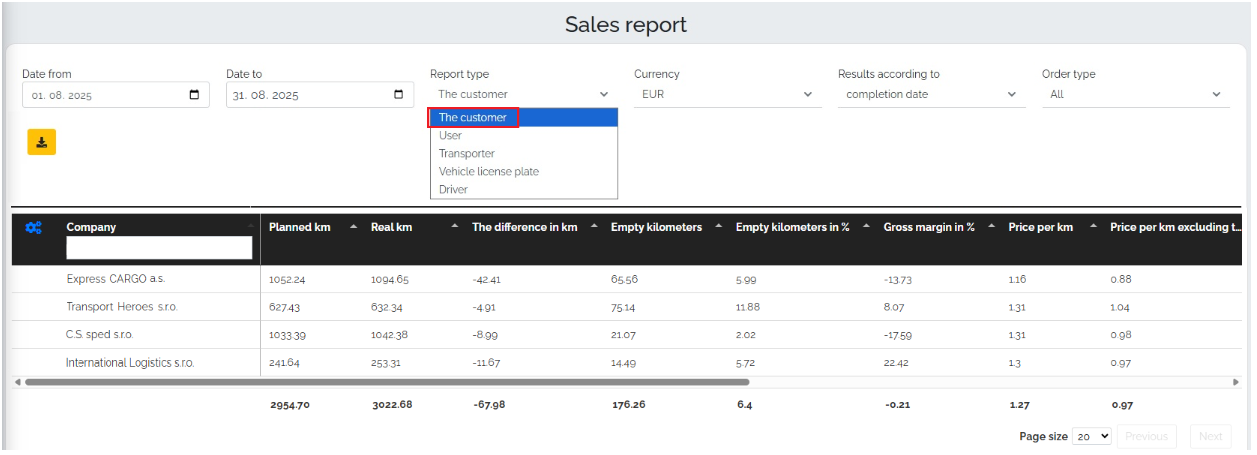

This report is a bit of a chameleon. Why? It changes depending on the focus of our company. It is clear that a trading company will be interested in different data than a transport company. For example, for a transport company, we can set individual filters in the report header:

- time period for which we want to create a report,

- report type (Customer, User, Carrier, Vehicle License Plate, Driver),

- menu,

- sorting results by order status: completed, accepted, fulfillment date, ready for completion,

- order type: all, custom, forwarding.

Of course, we can customize all available options. We can omit some data and thus truly tailor the report to our needs. It also includes a graphical display of individual data.

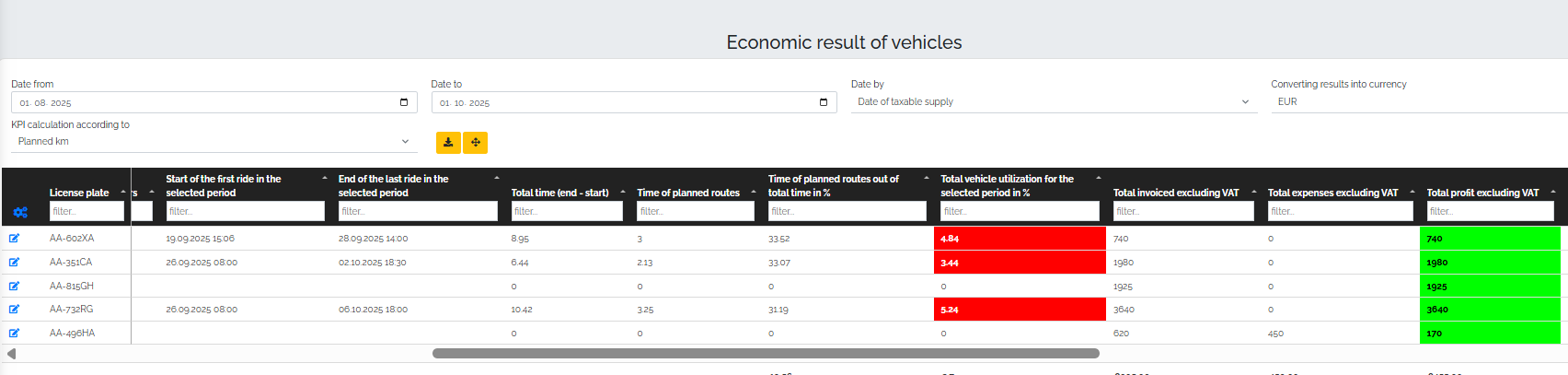

The report provides a quick and clear view of the company's operations – shows vehicle utilization and utilization, costs and opportunities for more efficient use of the fleetIt also reveals which vehicles are overloaded. It allows us to assess whether the pricing policy is set correctly and the transports are profitable considering the costs of vehicles and drivers.

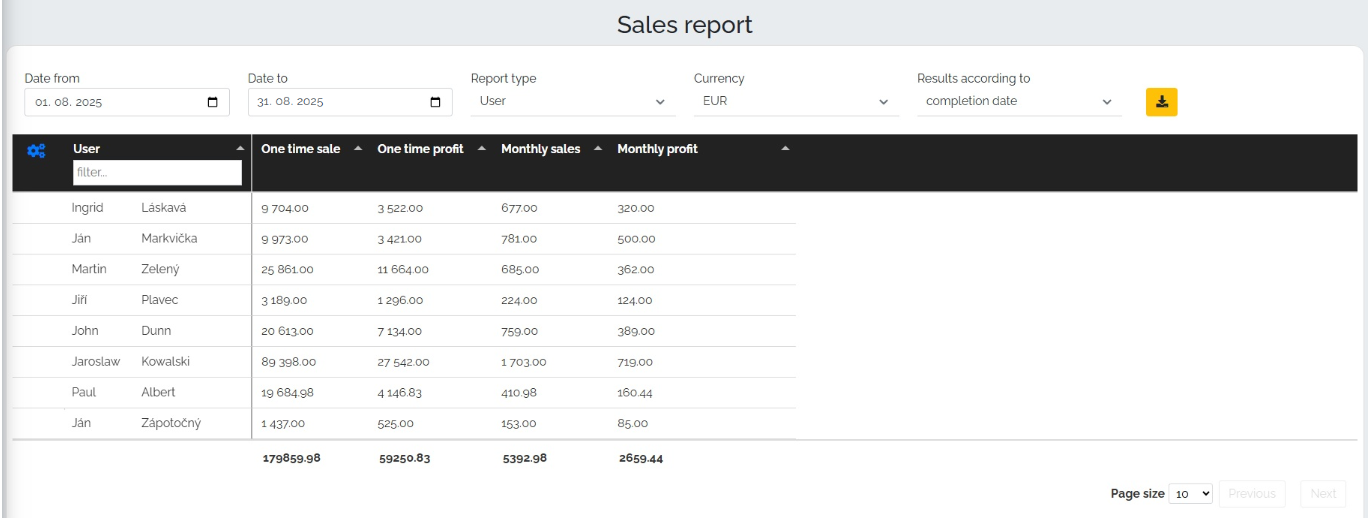

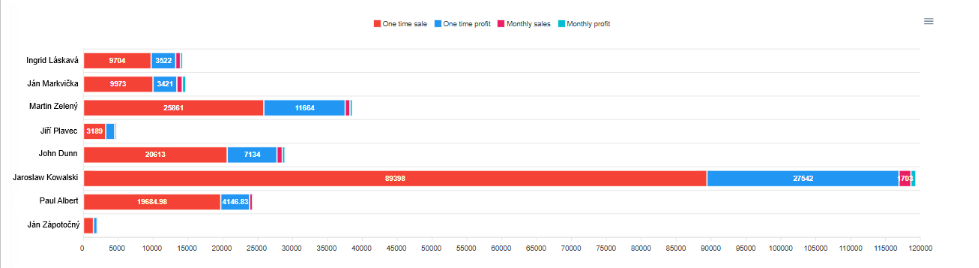

Let's take a look at the store environment. In a clear table and graph, you can see how individual salespeople or teams are doing.

The report can be filtered by:

- a salesperson or the entire team,

- currency, order, or fulfillment date,

- order status.

The manager will immediately know who is bringing the biggest turnover and where the reserves are.

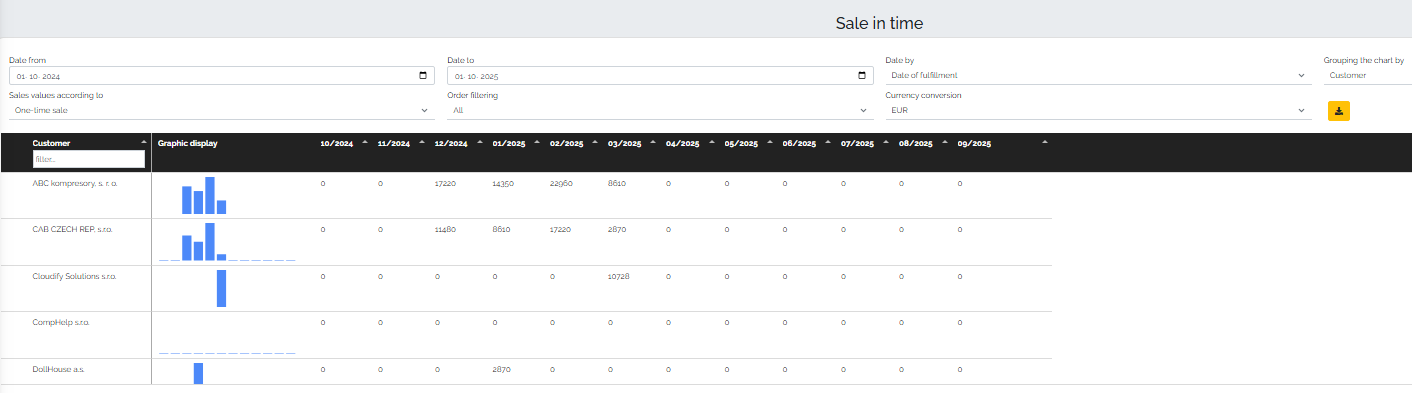

Sales over time - trends and seasonality

This report allows you to track sales by customer, merchant, or specific product/service, but on timeline. You can see who purchases regularly, whether any customers have stopped subscribing, or which products are selling the most in the selected time period.

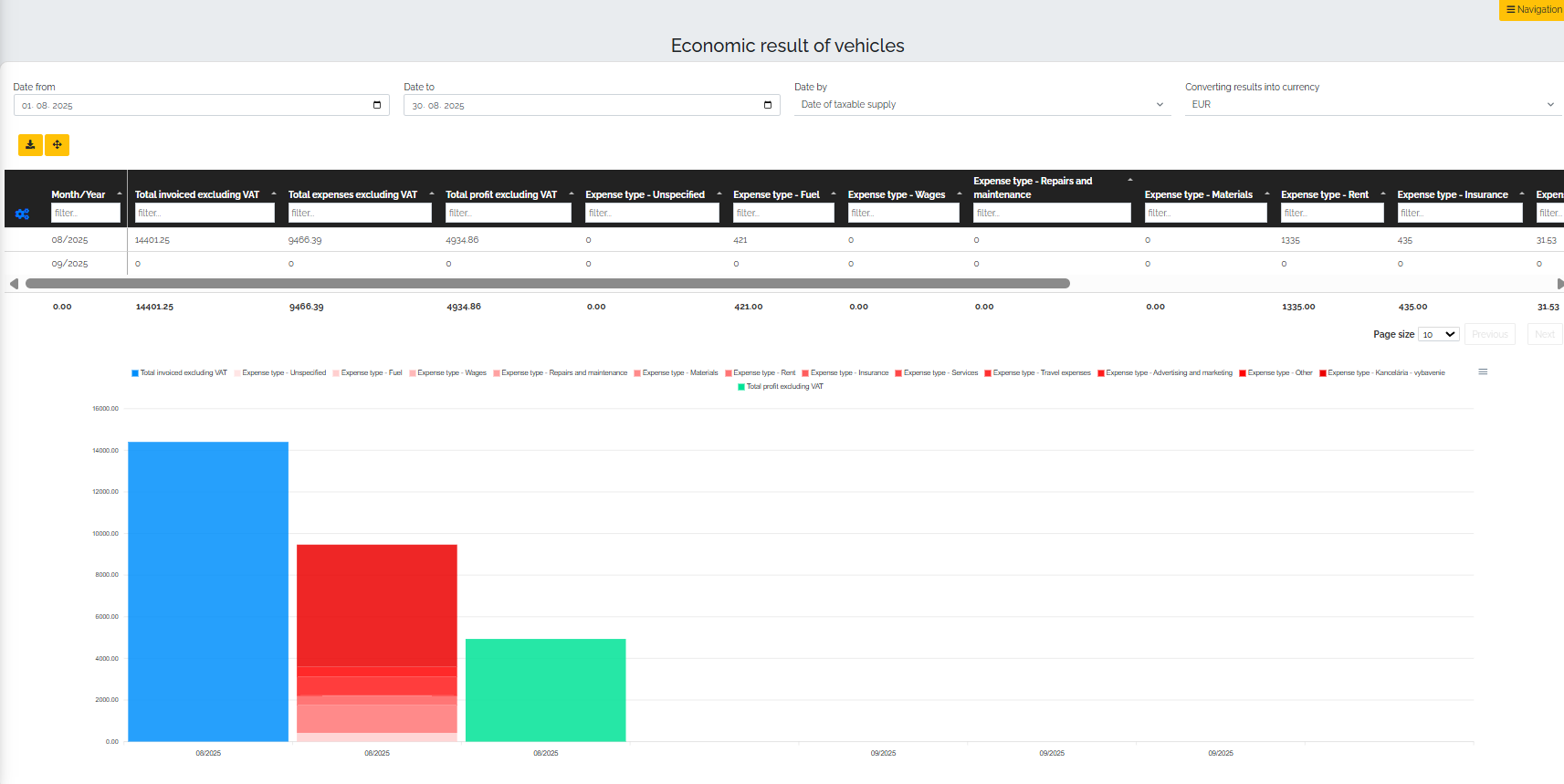

Economic result - see how your business is really doing

This report will be your effective navigator - you will have an immediate overview of where the company earns and where it spends. Here it is necessary for the company to record all invoices received. For the purpose of a more detailed report, it is ideal to select these invoices into individual categories (e.g. invoices for wages, rent, fuel, equipment, office, advertising). At the same time, it is necessary for the company to import invoices into CRM Mango or invoice directly in our CRM. Two things are essential for this report, namely to record what our expenses are, and on the other hand what we have invoiced. Subsequently, Mango can calculate for us very clearly, what is our profitMango can then display:

- total costs,

- total sales,

- net profit.

Another advantage is the color separation by category, so you can immediately you can see which item costs the company the most. The report can be viewed monthly and you can easily export the data to MS Excel if necessary.

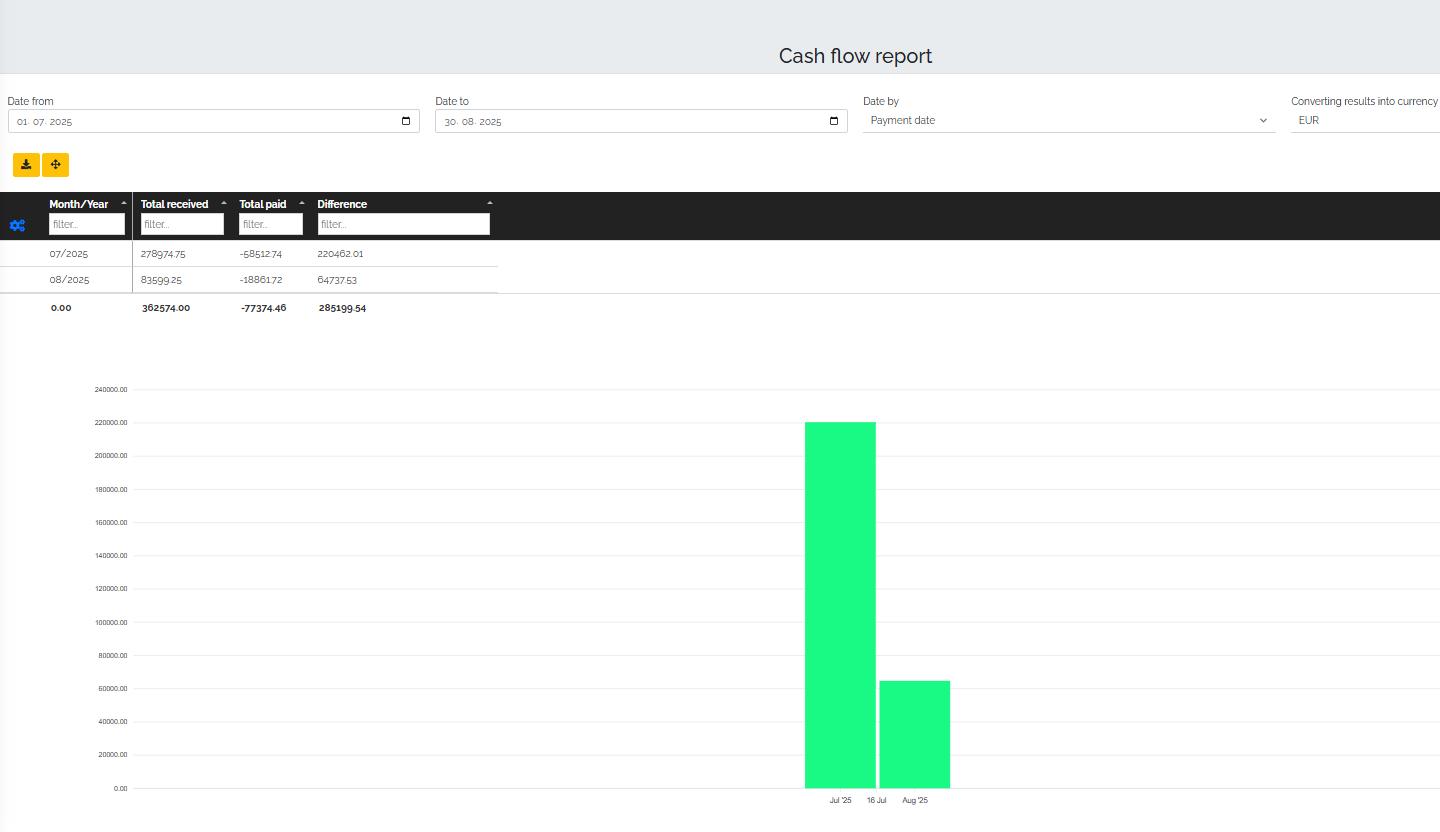

Cash Flow Report

Many companies show a profit on paper, but they lack money in the account. That is why the Cash-Flow report is key, as it shows how much money came into our account during the selected period - i.e. how many invoices customers actually paid and how much money left our account as our expenses. Thus, we see the difference between the sum of received and sent payments.

So in the economic result report, if it shows that we have invoiced for €50,000, then in this report Mango will clearly show us how much of this amount actually came into our account. Because, as we all know very well, it is not always just about invoicing, but also having the receivable paid. Often times, our customers/clients become insolvent (for various reasons). Since we are talking about the report showing us how many payments actually came into our bank account, for automatic evaluation it is necessary to have an active connection of our CRM with the bank. Thanks to this automatic connection with the bank (or manual entry of payments, whether issued or received), the company management has a clear overview of the financial reality of the company.